An Unbiased View of Estate Planning Attorney

Wiki Article

Some Known Factual Statements About Estate Planning Attorney

Table of ContentsExamine This Report about Estate Planning AttorneyWhat Does Estate Planning Attorney Mean?Estate Planning Attorney for DummiesThe Best Strategy To Use For Estate Planning Attorney

Estate preparation is an action plan you can make use of to determine what occurs to your properties and obligations while you're to life and after you pass away. A will, on the other hand, is a legal record that outlines exactly how properties are dispersed, that cares for youngsters and pets, and any type of various other dreams after you die.

Claims that are turned down by the administrator can be taken to court where a probate judge will certainly have the final say as to whether or not the insurance claim is valid.

The 10-Second Trick For Estate Planning Attorney

After the supply of the estate has actually been taken, the worth of assets determined, and tax obligations and financial debt repaid, the executor will then seek permission from the court to disperse whatever is left of the estate to the recipients. Any kind of estate tax obligations that are pending will certainly come due within 9 months of the day of fatality.

Each private areas their properties in the trust fund and names someone other than their partner as the beneficiary., to support grandchildrens' education.

Some Known Questions About Estate Planning Attorney.

Estate organizers can deal with the contributor in order to decrease gross income as an outcome of those payments or formulate strategies that optimize the impact of moved here those donations. view it now This is an additional approach that can be utilized to limit fatality tax obligations. It includes a private securing in the existing worth, and thus tax obligation liability, of their residential or commercial property, while attributing the value of future growth of that capital to an additional person. This method entails freezing the worth of a possession at its worth on the date of transfer. Accordingly, the amount of possible funding gain at death is also iced up, allowing the estate organizer to estimate their possible tax responsibility upon death and better strategy for the payment of revenue taxes.If adequate insurance profits are available and the plans are correctly structured, any kind of income tax obligation on the deemed dispositions of properties complying with the fatality of an individual can be paid without turning to the sale of properties. Earnings from life insurance policy that are received by the recipients upon the fatality of the insured are normally income tax-free.

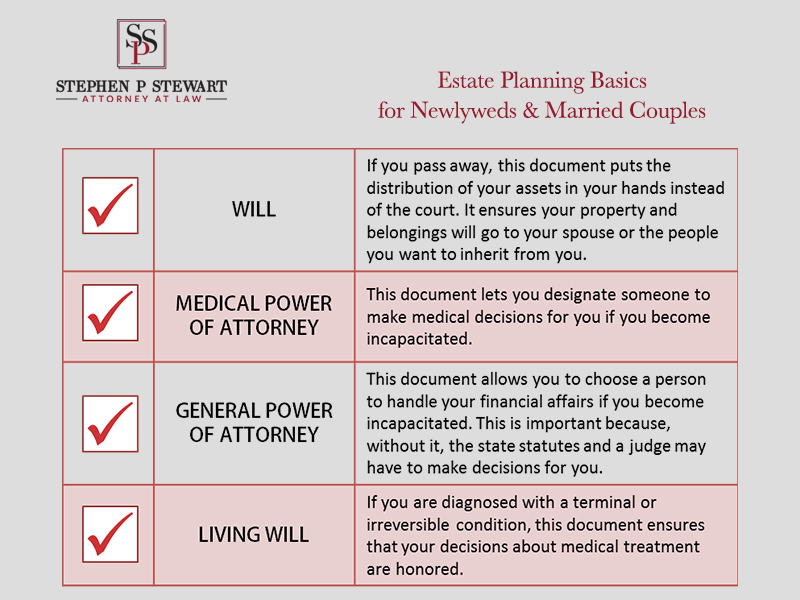

There are particular documents you'll need as part of the estate preparation procedure. Some of the most usual ones include wills, powers of attorney (POAs), guardianship classifications, and living wills.

There is a misconception that estate planning is only for high-net-worth individuals. Estate planning makes it simpler for individuals to identify their wishes before and after they die.

Our Estate Planning Attorney PDFs

You should begin preparing for your estate as quickly as you have any kind of quantifiable possession base. It's an ongoing procedure: as life progresses, your estate strategy must shift to match your circumstances, in accordance with your new objectives. And keep at it. Not doing your estate preparation can trigger undue economic concerns to enjoyed ones.Estate planning is usually considered a device for the affluent. But that isn't the situation. It can be a valuable method for you to manage your possessions and responsibilities before and after you pass away. Estate planning is likewise a fantastic method for you to lay out prepare for the care of your small kids and pets and to describe your want your funeral and preferred charities.

Applications should be. Eligible candidates who pass the exam will certainly be officially certified in August. If you're qualified to sit for the test from a previous application, you might file the brief application. According to the guidelines, no certification will last for a period longer than 5 years. Discover out when your recertification application is due.

Report this wiki page